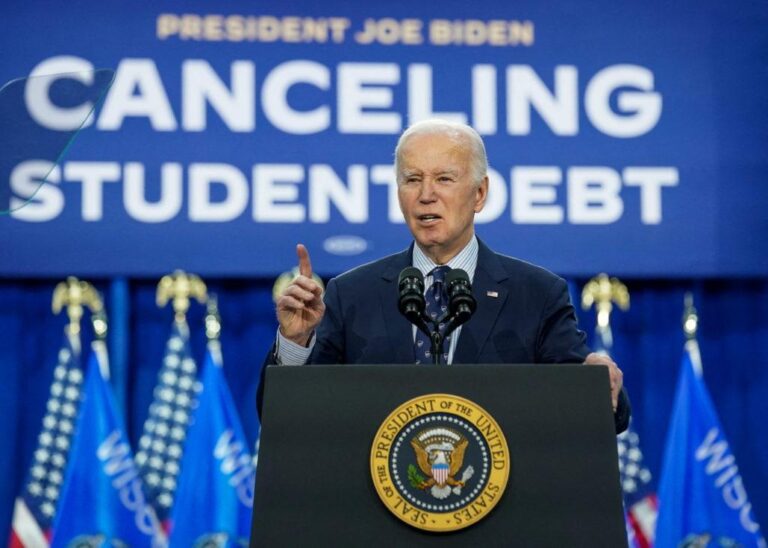

President Joe Biden has announced a historic move to forgive $37 million in student debt for thousands of former students of the University of Phoenix. The decision, aimed at providing financial relief to borrowers who attended the for-profit institution, addresses longstanding concerns over deceptive practices and subpar educational outcomes linked to the university. This significant debt cancellation marks one of the largest targeted student loan forgiveness efforts under the current administration, reflecting continued efforts to tackle the growing crisis of higher education debt in the United States.

Biden Administration Cancels $37 Million in Student Debt for University of Phoenix Attendees

In a major move aimed at alleviating the financial burdens on former students, the Biden Administration has announced the cancellation of $37 million in student debt for attendees of the University of Phoenix. This decision reflects the administration’s commitment to provide relief to borrowers impacted by institutional misconduct and to support fair access to higher education. The debt relief applies to thousands of borrowers whose education experience was compromised by alleged misleading practices from the for-profit institution.

This initiative is part of a broader federal effort to address student loan forgiveness and has been welcomed by advocacy groups who argue that the loan cancellations will significantly aid in economic recovery and personal financial stability for the affected students. Key highlights of the debt cancellation include:

- Debt relief automatically applied to eligible borrowers’ federal student loan balances

- No application required for forgiveness under this specific action

- Focus on students who attended between 2012 and 2020

- Supports a national strategy to hold for-profit institutions accountable

Impact on Borrowers and Eligibility Criteria for Debt Forgiveness

Borrowers affected by this debt forgiveness initiative can expect significant financial relief, potentially lifting a heavy burden that has long impacted their credit and economic mobility. The move primarily benefits former students of the University of Phoenix who took out federal student loans but fell victim to alleged deceptive practices by the institution. Many of these borrowers faced difficulties repaying their loans due to concerns about the quality of education received and questionable recruitment tactics. With this forgiveness, those borrowers will see their federal student loan balances reduced, directly impacting their monthly obligations and overall financial wellbeing.

Eligibility for this forgiveness program is determined by specific criteria designed to ensure that only those genuinely harmed receive debt relief. To qualify, borrowers must:

- Have attended the University of Phoenix during the specified period linked to the complaint.

- Have federal student loans in active repayment or delinquency status.

- Submit a formal application demonstrating that their enrollment circumstances align with the issues outlined in the federal review.

Loan Types Covered:

| Loan Type | Eligibility Status |

|---|---|

| Direct Subsidized Loans | Eligible |

| Direct Unsubsidized Loans | Eligible |

| PLUS Loans | Eligible under specific conditions |

| Private Loans | Not eligible |

Analysis of University of Phoenix’s Role in Federal Student Loan Controversies

The University of Phoenix has long been a focal point in discussions about federal student loan controversies, particularly due to its aggressive recruitment practices and high student loan default rates. Critics argue that the institution’s business model prioritized enrollment numbers over educational outcomes, leading many students to accumulate significant debt without obtaining the promised career advancement. This history has culminated in increased scrutiny from both federal regulators and advocacy groups, who have sought to hold the university accountable for its role in perpetuating predatory lending practices in higher education.

Recent government actions reflect this ongoing concern, with the Biden administration’s decision to forgive $37 million in student debt specifically targeting former University of Phoenix students. This move is seen as an attempt to provide relief to individuals adversely affected by the institution’s practices. Key factors influencing this debt cancellation include:

- High loan default rates: Indicating systemic issues in student loan repayment among the university’s alumni.

- Questionable recruitment tactics: Allegations of misleading marketing about job placement and program quality.

- Federal investigations: Probes that revealed discrepancies between reported and actual student outcomes.

| Factor | Impact | Outcome |

|---|---|---|

| Loan Default Rate | High among alumni | Raised Federal Concern |

| Recruitment Practices | Questionable marketing claims | Increased Scrutiny |

| Federal Investigations | Exposed discrepancies | Debt Relief Programs Initiated |

Advice for Former Students on Navigating Loan Relief and Future Financial Planning

For those impacted by the recent loan forgiveness decision, it is crucial to thoroughly understand the steps required to benefit from this relief. Start by verifying your eligibility through official platforms and complete any necessary verification forms promptly. Keep copies of all correspondence, and regularly check your loan servicer’s website for updates. Staying proactive can prevent delays and ensure that the forgiven amount is properly applied to your account.

- Review your tuition and loan statements for accuracy.

- Consult a financial advisor to reassess your budget post-forgiveness.

- Explore income-driven repayment plans if other loans remain.

- Establish an emergency fund to avoid future debt stress.

| Action | Timeline | Benefit |

|---|---|---|

| Confirm loan forgiveness status | Within 30 days | Avoid unnecessary payments |

| Update financial plan | Immediately after confirmation | Optimize debt management |

| Consult credit counselor | 1-2 months after forgiveness | Maintain healthy credit |

Looking beyond forgiveness, designing a sustainable financial future involves setting clear goals and understanding debt’s impact on credit health. Former students should focus on rebuilding or maintaining strong credit scores, avoiding high-interest debt, and investing in education or retirement. Additionally, developing habits like tracking expenses, saving consistently, and periodically reviewing financial goals will empower borrowers to avoid similar predicaments and leverage newfound financial freedom effectively.

Final Thoughts

As President Biden moves forward with forgiving $37 million in debt for former University of Phoenix students, the administration underscores its commitment to addressing the burden of student loans and supporting borrowers affected by predatory lending practices. This decision signals a continued focus on debt relief as a key component of the broader agenda to make higher education more accessible and affordable for Americans. Stakeholders will be watching closely to see how this and other relief measures impact the future of student loan policy nationwide.